According to Ernst & Young, deploying new commercial real estate data and analytics tools is the #1 technology priority for commercial office owners in a post-COVID world. There are many reasons to invest in such tools, but since most tenants and their employees have been working from someplace other than their office this past year, it is not unreasonable to assume that chief among these reasons is the desire to increase customer — or tenant — retention through tenant experience analytics.

One of the most notable examples of data’s ability to impact a business comes from Netflix. As a monthly subscription service, the success of Netflix’s business depends on retaining customers month over month.

Like most companies, Netflix relied on customer feedback to drive decision-making in the early days, but there was a problem: most unhappy customers don’t complain. In fact, only 1 out of 26 unhappy customers complain or give feedback, and by the time the rare complaints did come from Netflix customers, it was often too late to win them back.

Netflix could not rely on their customers to raise a red flag, gauge their experience, or express their satisfaction in a way that effectively predicted the likelihood that they would cancel or renew the streaming service. Thinking there had to be a better way, they came up with a hypothesis: if they couldn’t rely on their customers’ words, perhaps they could rely on their actions — or behavior — to predict retention.

Fortunately for Netflix, this approach proved to be extremely effective; they were able to identify the amount of activity an individual customer needs each month to be considered likely to renew their subscription. If a customer’s activity was below this threshold, the likelihood of them canceling their subscription increased greatly.

With the help of this powerful new performance metric, Netflix was able to strategically invest in communication tools and a recommendation engine that drove engagement with their at-risk customers. As of 2015, Netflix executives estimate that this saves the company $1 billion a year.

For the commercial real estate (CRE) readers currently wondering what a streaming service has to do with operating a portfolio of physical office buildings, I would remind you that, for the first 10 years of Netflix’s life, it was a business built around physical assets (DVDs) that they shipped to customers across the country. It was Netflix’s focus on solving customer problems and creating customer value that led to their streaming innovations and eventual pivot to the global, original content-creating powerhouse that it is today.

Additionally, the current state of gathering tenant data in CRE is much like the early days of Netflix, relying too heavily upon direct customer feedback via annual, semi-annual, or quarterly tenant polls to predict retention and overall satisfaction.

Just like Netflix, we here at HqO believe there needs to be a better way. The ability to adapt asset strategies based on changes in tenant behavior and tenant sentiment is paramount for any ownership or property team looking to ensure the long-term value of their assets. Owners and operators who effectively deploy technology to collect, store, and learn from tenant data will separate themselves from the pack and accelerate leasing cycles, improve tenant retention, and optimize operational efficiency within their portfolio.

This is why we created Digital Grid Analytics.

Digital Grid Analytics:

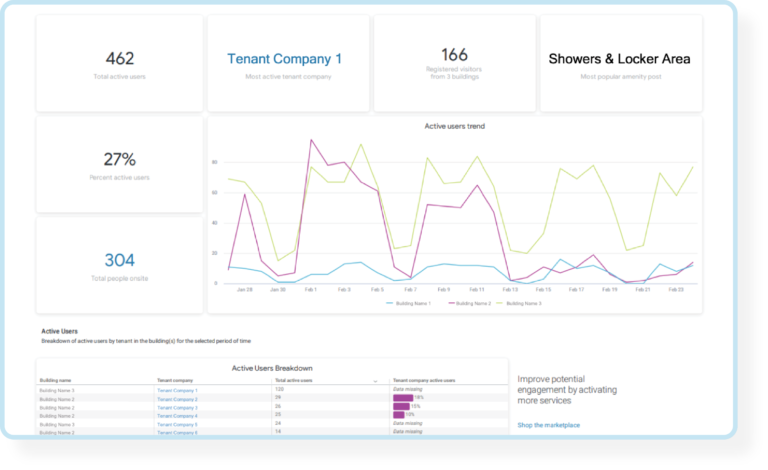

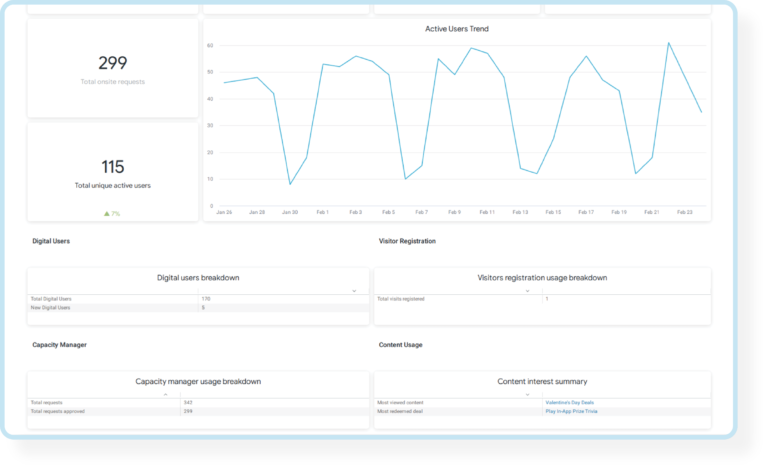

The Digital Grid centralizes key tenant metrics so portfolio managers, asset managers, and property managers can uncover data-driven insights and take action to improve their assets. We help you create tenant value by providing behavior data that allows you to discover who is in your building(s), how those people are using your spaces, and how they are experiencing your offerings (amenities, programming, and more).

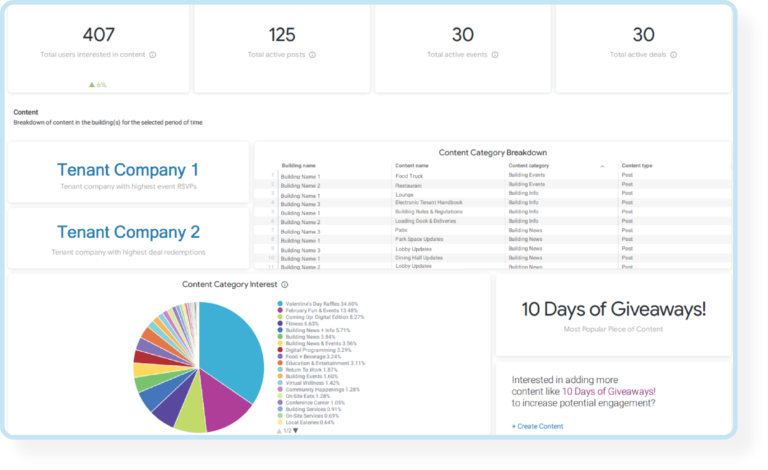

Today, we released several new dashboards that provide a complete picture of your assets, starting with the spaces in your building and who is frequenting these spaces. Then, HqO supplements data on the physical world with metrics on tenant experiences. For example, what content tenants are most interested in, how often they are coming to the building, what restaurants they order from, and much more. By centralizing and organizing these key data points, you have a reliable, real-time view into tenant sentiment, so you can make data-driven decisions to increase retention, inform CapEx decisions, and ultimately increase NOI.

Let’s dive in and see the powerful data visualizations you can find in the Digital Grid:

The “Spaces” Section:

This is where you can see centralized dashboards on all the suites, floors, and space types (common area, retail, etc) within your assets and what resources are available to tenants throughout your portfolio, as well as track the overall usage of those spaces to inform future investments into tenant resources.

The Spaces section includes the Overview, Usage, and Resource Booking dashboards, and they provide data that helps you understand how often tenants leverage available amenities like conference rooms or fitness centers. This data can uncover insights around what spaces provide real, tangible value to tenants, so you can feel confident when investing (or saving) time and capital into a tenant improvement project.

The “People” Section:

This is where you can find detailed dashboards on the types of tenants in their buildings, the number of tenants using the platform, and how those tenants use your tenant experience platform over time. This provides the information you need to create tailored engagement plans and guide decisions on your tenant retention strategy.

The People section includes the Building Population, Engagement, and Tenant Company dashboards, which you can leverage to uncover key insights about tenant interests. Let’s say, for example, you have a large tenant whose lease expires in two years that you want to retain – you can come to this section of the Digital Grid and quickly see what events and deals have been most successful with that tenant, as well as what days of the week that tenant is most likely to engage with your programming. Based on this information, the property team or asset manager can create a tailored retention strategy that they know will resonate with and reach their target audience.

The “Experiences” Section:

This is where you can see centralized and categorized dashboards on the experiences available to tenants within your portfolio, allowing you to see how each of your assets compares to commercial real estate benchmarks. This section also provides a view into which content, events, deals, and retailers are most popular with tenants.

The Experiences section includes the Amenities & Experiences, Programming, and Order Ahead dashboards. You can use the data here to ensure that you are properly deploying your tenant experience budgets efficiently. There is nothing more frustrating to an asset or property team than spending a ton of time and effort on a tenant appreciation event or initiative, only to have a few people show up or have it fall flat with tenants. With the Experiences dashboards providing clear insights into what tenants engage with, you can be confident your team is spending their time and money effectively when putting together tenant events or programs.

With the release of these latest analytics dashboards, you have a reliable, real-time view of your portfolio’s buildings, tenants, and experiences, allowing you to make data-driven decisions to increase retention, inform CapEx decisions, and ultimately increase NOI.

If you want a personalized tour of the Digital Grid, click here.